Introducing the Unemployment Claims Monitor

Stuart Andreason

May 6, 2020

2020-04

https://doi.org/10.29338/wc2020-04

Download the full text of this paper (606 KB)

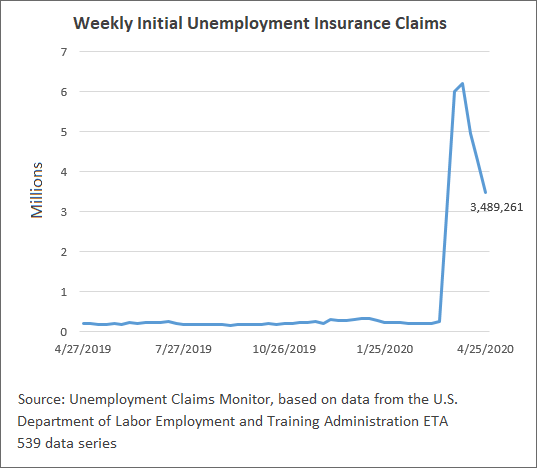

The COVID-19 pandemic has caused an unparalleled economic slowdown and record numbers of layoffs. Even casual economic observers have seen reports of millions of workers filing claims for unemployment insurance—between the weeks of March 21, 2020 and April 25, 2020, 19 percent of workers covered by unemployment insurance filed an initial claim—but what exactly does this mean for unemployment?1 It is important to understand exactly what an unemployment insurance (UI) claim represents and how it provides information on what is happening in the economy.

The Center for Workforce and Economic Opportunity (CWEO) launched the Unemployment Claims Monitor on May 1, 2020, to provide comprehensive and easily accessible data on unemployment insurance claims so that policymakers, researchers, workforce development programs, and nonprofits can have an additional perspective into trends on unemployment.2

The unemployment insurance system provides compensation for workers who lose their jobs involuntarily, typically due to lack of work available to them. An unemployment insurance claim is when a worker files to receive compensation through the UI system. Not every worker qualifies for the unemployment insurance system; only workers who work for a wage and have a W2 tax form at the end of the year qualify. The pool of workers engaged in this relatively traditional employer-employee arrangement are often referred to as "covered employees." UI claims data provide a window into what happens to these workers. While there have been some significant changes to the UI system through recent legislation, including the CARES Act, the data that have been released so far provide a window into the economic conditions of workers who work in UI-covered employment.

Contract workers, also known as 1099 workers or gig workers, are not part of the UI system—workers under this arrangement do not pay into the UI system and cannot receive traditional benefits. When a contract worker loses his or her job due to low demand, that job loss is not captured in the traditional data. The CARES Act created the Pandemic Unemployment Assistance (PUA) program, which provides unemployment compensation supports to these workers that are parallel to the UI system.

State programs have quickly adopted this new unemployment compensation program and will begin reporting claims in the coming weeks. When data on PUA claims become available, they will be added to the Unemployment Claims Monitor. By condensing data into one readily available, time-based dashboard, users will have a comparative window into the varying economic and labor market experiences of traditional W2 employees and contract or 1099 workers. Research into these differences will provide critical information to policymakers thinking about future employment insurance systems.

The Atlanta Fed also created the Unemployment Claims Monitor to better understand who was filing unemployment insurance claims and the geographic, demographic, and industrial concentrations of job losses. The tool is designed to answer some of these questions:

How have claims varied from state to state?

States have different economic composition, concentrations, and specialties. These differences can influence how firms are affected by economic shocks. Additionally, differences are a window into the outcomes of different policy strategies. The unemployment insurance system is a partnership between the federal government and state governments: states administer the program, and all have slightly different eligibility and benefits rules. These rules can affect the number and timing of claims. Continued research on the variation between states can help provide more information on both economic shocks and state policy strategies.3

What industries are affected?

Understanding which industries are driving UI claims is yet another perspective into which industries are affected by an economic shock or stress—and can show which are rebounding more quickly. The Unemployment Claims Monitor provides that data, which are only reported on a monthly basis. So a look at the monitor in early May will not fully capture the effects of COVID-19 on industries.

Who is applying for unemployment insurance?

Claimant demographic data are also critical to better understand who is dealing with economic stresses. Economic shocks are not experienced equally. The Unemployment Insurance Monitor provides data on the gender, ethnicity, age, and race of claimants. That data can help inform outreach strategies and policies to identify and support workers who experience disparately larger economic stresses and job loss.

The tool also provides data on special programs in the UI system, including data on unemployment compensation for federal employees, unemployment compensation for ex-service members, and participants in programs like Short-Time Compensation (Workshare), which support workers who have been furloughed and not laid off.

How can I use the Unemployment Claims Monitor to understand UI claims?

One of the benefits of the Unemployment Claims Monitor is that it provides comparative data. Policymakers and programs may want to focus on conditions in a specific state, and clicking on the map in the tool will adjust data throughout to present local conditions. Multistate regions or entities may want to know about claims conditions across several states. Users can simply "control-click" the states of interest. Users can similarly filter to focus on specific industries or demographic characteristics that are relevant to their work.

The tool provides timely data to users and will update every Thursday when new data are released. The data provide important and often early trend changes in economic conditions. The tool will help develop both research and solutions that address the challenges that all workers face—and when PUA data on contract workers are available, that data will serve as an important benchmark.

Our CWEO team welcomes partnership with policymakers, practitioners, and researchers to utilize the Unemployment Claims Monitor to advance your work to support workers who have lost their jobs. Do not hesitate to contact Stuart Andreason or Mels de Zeeuw with any questions.

Stuart Andreason is the director of the Center for Workforce and Economic Opportunity.

_______________________________________

1 The headline number from the weekly unemployment insurance claims report is for initial claims—these are claims that have been entered into the system—and some initial claims will eventually be denied. A worker who is unable to file a claim in any given week can file later and receive retroactive UI compensation; some claims in a given week could be representative of job losses that happened a few weeks earlier. Continued claims are ones where the claimant is likely receiving UI benefits. During the week of April 11, 2020, 11.1 percent of covered employment was on a continued UI claim.

2 Another Atlanta Fed tool, the Labor Report First Look, provides a detailed analysis of the monthly unemployment report—a different and critically important view on unemployment trends.

3 Some states publish county-level unemployment insurance claims. County-level data across a greater number of states would additionally allow for further research on how regional economies and localities feel the effects of economic shocks. Future research and data collection are critical as well.