Talent Finance: Exploring the Future of Workforce Partnerships

Stuart Andreason, Sarah Miller, and Katherine Townsend

September 21, 2020

2020-12

https://doi.org/10.29338/wc2020-12

Download the full text of this paper (518 KB)

In 2020, our economy competes on talent. The labor market is dynamic, with in-demand skills constantly changing. A dynamic economy can create opportunities for workers, but it also creates risk. Investing in talent development—or talent finance—is imperative for companies and workers to succeed, but with the evolving nature of our global economy, our old systems of talent finance do not always work. Talent finance refers to the development and use of public and private instruments for investing in talent development and in managing related downside employment and income risks.

As early as the 1950s, large employers provided in-house professional and technical training. During this era of talent development, employees and employers had direct communication about in-demand skills, but smaller employers were not able to compete with large ones, mostly due to a lack of resources. Large corporations mainly financed these programs, removing the risk from governments or education systems.

Throughout the 1980s, corporations scaled back in-house training, and public higher education began to play a major training role. This changed structure of the workforce system provided new benefits. For instance, it leveled the playing field for small and large employers. The shift resulted in a cost and risk transfer from employers to government and education entities. While the shift saved money for employers, the challenge came in employers communicating and managing relationships with external education and training providers and in ensuring that employees were updating their skills for existing jobs and career advancement.

Currently, many employers think education and training entities need to be more agile, quickly pivoting talent development strategies. Other observers argue that employers need to provide more clarity and communicate the skills needed. Thus far, these groups have been able to make only incremental gains in addressing the problem, since the incentives have not changed. Regardless of responsibility, even some college-educated workers find themselves with a skills gap.

We are moving toward an innovation-based global economy that will be driven by talent. This fundamental economic shift will bring major disruptions for employers, learners, students, and workers alike. Ultimately, employers will increasingly compete on innovation, agility, and resilience, also driven principally by talent. Therefore, talent development and engagement will be key factors in their success.

Today's system includes many types of workforce development efforts. However, it has moved little from focusing on formal education and training through traditional college pathways. The focus on college education has been expensive, costing $30 billion on Pell Grants and more than $100 billion in loans annually. As student loan debt passes the $1.5 trillion mark, the likelihood of defaults on those loans only increases.

Other challenges include the increased time it takes for students to transition from college to a career because they lack the skills that employers need. Since the 1980s, wealth inequity has grown, indicating that the current system benefits some populations more than others.

The country needs a public-private approach that can forge a new consensus and strike the right balance between the roles of employers, workers, and government in talent finance and risk management. "The approaches for financing talent in the 21st century should adapt to our current economic needs—not those of the 20th-century economy," says Jason Tyszko, vice president of the Center for Education and Workforce at the U.S. Chamber of Commerce Foundation. "Talent shapes how we compete, but the tools we currently have are ill-equipped to meet the needs of today's dynamic labor markets where existing skills are changing, and new skills are emerging." The Center for Workforce and Economic Opportunity at the Atlanta Fed is excited to work with the U.S. Chamber of Commerce Foundation to build on this idea, foster relationships, and create open dialogue with the Talent Finance initiative.

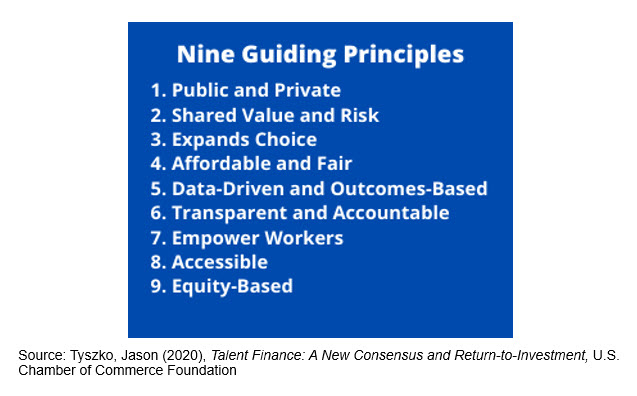

The initiative will use nine guiding principles for engaging stakeholders and developing programs that promote global competitiveness and economic opportunity. In summary, the initiative will focus on collaborative approaches in which stakeholders—including employers, all types of education providers, and government—share the value and risks. Programs should empower all workers, including low- to moderate-income populations. The initiative will create inclusive, affordable, and equitable pathways to narrow the skills gap.

These principles will encourage public-private collaboration, promote shared value and risk, and advance innovations that are inclusive, expand choice, and promote equity. They also will promote data-driven and outcomes-based innovations while also contributing toward a more transparent and accountable talent marketplace.

Join us as the U.S. Chamber of Commerce Foundation, the Atlanta Fed, and a group of partners host a series of virtual forums that will make the case for a new public-private approach for how we finance and invest in talent to build the workforce of the future. For more information, visit the Talent Finance web page. There, you can read a recently posted white paper about the initiative. Register and save these dates to join the conversation. All events start at 1:30 p.m. (ET). We look forward to working with you on these solutions.

- September 22, Forum 1: Kickoff Event

- September 24, Forum 2: Building Partnerships

- September 29, Forum 3: Public-Private Innovations

- October 1, Forum 4: Enabling Infrastructure

- October 13, Forum 5: Capstone Event

Stuart Andreason is the director of the Center for Workforce and Economic Opportunity, where Sarah Miller is a senior adviser and Katherine Townsend a research analyst I.