Who Has COVID-19 Impacted and What’s Been Done to Help?

Stuart Andreason and Katherine Townsend

December 18, 2020

2020-15

https://doi.org/10.29338/wc2020-15

Download the full text of this paper (238 KB)

The U.S. Bureau of Labor Statistics (BLS) reports the unemployment rate monthly. Generally, it gives an idea of the number of Americans who are out of work and looking for new employment. During times of economic stress, however, this metric may not paint a full picture of those who are out of work.

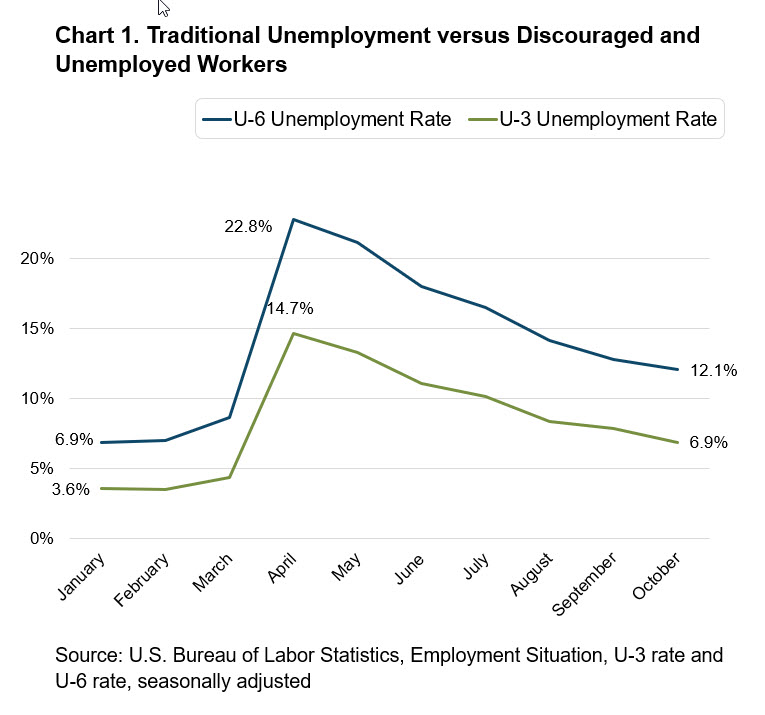

Headline unemployment numbers can be misleading, and the COVID-19 pandemic has affected the accuracy of the picture painted by the headline unemployment numbers. For instance, the October jobs report from the BLS identified 11.1 million unemployed workers, or 6.9 percent unemployment (see chart 1). But this number—the traditional unemployment rate, or U-3—includes only those workers who are out of work and actively searching for a job.

Some consider the U-6 unemployment rate to be more representative of the labor market’s status, even during periods of economic growth. The U-6 unemployment rate includes discouraged workers (those who have been out of work for at least a year but have not searched for work in the last four weeks), people working part-time who would rather be working full-time, and people without a job who may be in school or are no longer searching for a job due to a disability.

According to the October jobs report, the gap between traditional U-3 unemployment and the U-6 rate increased from 3.3 percent to 8.1 percent between January and April. While this gap has narrowed to 5.2 percent, U-6 unemployment is still well over 10 percent. The workers in this category would not be included in unemployment claims or the headline unemployment number often used to characterize a recovery.

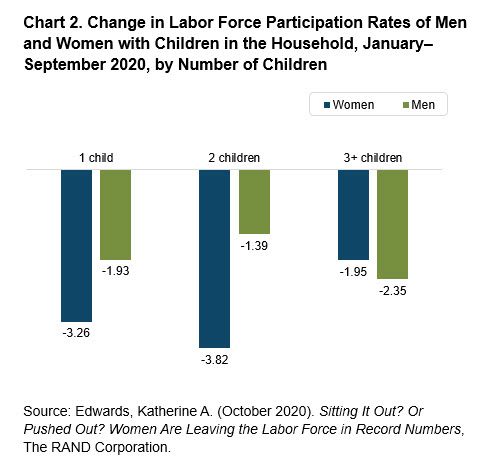

The pandemic has done more than discourage workers from job searches. It has shifted the responsibilities of a large section of the labor force: people caring for children or family members—mothers and women, in particular. Women have dropped out of the labor force at a faster rate than men since the start of the pandemic. Compared to October of 2019, the labor force has 2 million fewer women—almost 1 million more than the drop in the male labor force. The RAND Corporation analyzed the change in labor force participation by gender and by number of children. In most family structures, women dropped out of the labor force more often than men, with the largest decline in women with two-child households (see chart 2).

A recent working paper on the topic showed a correlation between the drop in labor force participation and school closures, further suggesting that mothers are dropping out of the labor force to provide increased caretaking for the children in their household. More strikingly, the analysis revealed that nearly 90 percent of the women who dropped out of the labor force were mothers.

As workers drop out of the labor market, they are no longer counted in the BLS monthly unemployment statistic. Labor force participation has dropped 1.9 percent since January 2020. In times of economic stress and as crises unfold, other measures, like the weekly number of jobless claims and the number of workers collecting unemployment insurance, among others, are good alternative measures of labor market disruption and joblessness.

The traditional unemployment insurance system has not served all workers, including gig workers. While there are different definitions for gig workers, it generally means workers who are either self-employed or have a nontraditional work agreement. The number can be hard to measure, since some of these workers hold more than one “gig” (think of a driver who works for Lyft and Uber). Gig workers are not traditionally eligible for unemployment insurance, which means that it is hard to estimate the impact of recessions on the “gig economy.”

The CARES Act

While Congress could not have predicted all of the problems the coronavirus pandemic would cause in the labor market, it anticipated some when it passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act in late March. The bill provided relief for many sectors of the economy and created three major programs to relieve pressure on unemployed workers: Federal Pandemic Unemployment Compensation (FPUC), Pandemic Unemployment Assistance (PUA), and Pandemic Emergency Unemployment Compensation (PEUC). All three programs targeted different challenges unemployed workers faced at the onset of the COVID-19 crisis.

The FPUC provided an additional $600 payment each week to help workers who lost their jobs due to widespread economic shutdowns cover expenses. The unemployment insurance system was never meant to provide full replacement of lost income, but the $600 additional payment could help families cover a greater portion of lost household income. In some cases, it even overshot 100 percent wage replacement. This program expired on July 31, 2020, when Congress failed to pass another relief bill.

The PUA was a completely new program that allowed gig workers, contractors, part-time workers, and people who were self-employed to apply for unemployment compensation. This group could also collect the $600 FPUC through the end of July if they were eligible. As reported on December 10, 8.6 million workers filed a continued claim. This program is set to expire on December 31, 2020.

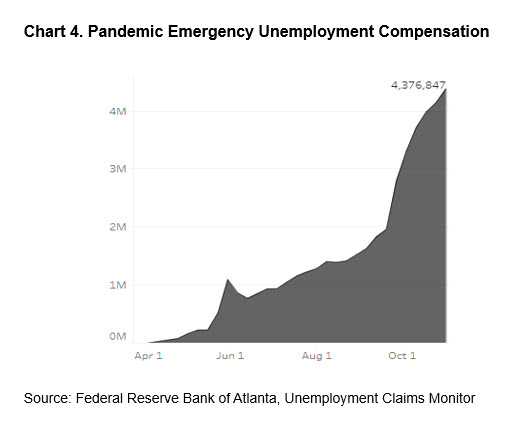

Finally, the PEUC extended regular state benefits by 13 weeks. In most states, unemployment insurance lasts 26 weeks, or six months. However, during periods of severe unemployment, Congress and states can choose to add more weeks to the standard 26-week limit. The PEUC benefit was available to workers who lost their jobs during the pandemic as well as before it, because those workers faced the same challenging job market. The PEUC will also expire at the end of 2020.

A look at the pandemic unemployment programs

During its brief turn, the FPUC faced severe criticism. Some policymakers worried that the high replacement rate would disincentivize workers to return to their jobs. However, research collected by the U.S. Senate’s Joint Economic Committee showed no evidence that such a trend occurred. Proponents of the bill argued that the extra payment helped keep the economy afloat by allowing laid off or fired workers to pay bills, buy groceries, and increase the flow of money in their local economy. Research by JP Morgan Chase, Moody’s Analytics, and the Economic Policy Institute suggests that higher unemployment insurance payments reduce a drop in spending with job loss and boost overall economic activity. Nonetheless, this portion of the CARES Act expired on July 31, 2020.

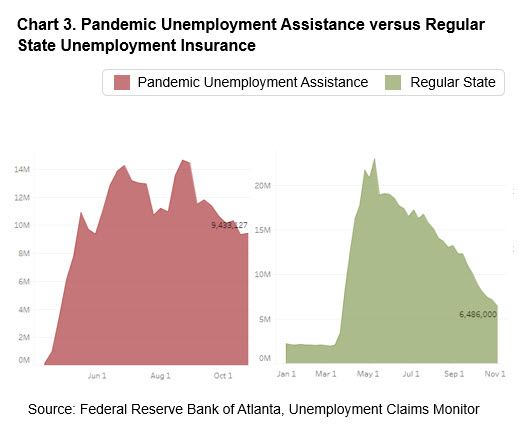

The Atlanta Fed’s Center for Workforce and Economic Opportunity released the Unemployment Claims Monitor in March. This tool tracks the number of unemployed workers by program, including the PUA and the PEUC. The report released on December 10 showed 8,555,763 PUA claims. The PUA claims outnumbered traditional unemployment claims by 3.11 million and showed an increase in 36 states.

Unlike traditional unemployment benefits claims, which peaked the week of May 9 and have slowly declined since (though the number is still much higher than pre-pandemic), PUA usage peaked the week of August 22, with over 14 million claims (see chart 3). The Century Foundation estimates that 7.3 million workers will lose their PUA benefits at the end of the year and will have no other forms of unemployment insurance available to them.

Unlike the FPUC, which expired in July, when the PUA expires, it will not simply decrease the amount of unemployment insurance workers can collect. Expiration will completely eliminate any unemployment compensation. Without an extension of the program, contractors, entrepreneurs, and gig workers will lose all of their unemployment benefits.

Since June, there has been steady growth in the number of workers enrolled in the PEUC program, suggesting that workers are exhausting their eligibility in the state program. Since September 19, the number of workers in the PEUC program has more than doubled, from 1.9 million to 4.5 million as of November 21 (see chart 4). Researchers at the Century Foundation estimate that the number of PEUC claimants will not have declined by the time the program expires at the end of the year. However, they note that the number may not increase, either. They attribute this stagnation not to workers no longer needing the benefit but to the fact that 3.5 million workers will have exhausted their PEUC benefits by the December 31 cutoff date. The growth in the number of PEUC claimants also signals growth in the number of workers who are at risk of long-term unemployment.

States have the option to continue extended benefits into 2021. The major difference between state extended benefits and the PEUC is who pays, whether it’s the federal government or the state. So far, the federal government has paid for PEUC benefits, but any extended benefits in 2021 would be financed through state unemployment funds, which, in many cases, are running low. Moreover, not all workers are automatically entitled to extended benefits: only 17 states offer them.

Labor market impact in 2021

In 2020, no single measure has captured the pandemic’s impact on the labor market. More than 63.8 million people have filed traditional unemployment claims in 2020. As of December 10, 22.4 million people have filed for the PUA at least once. And as of October, the labor market has lost 2.2 million women and 1.3 million men. In total, there have been roughly 89.2 million job separations, meaning more than half of the labor market—160 million Americans—have been affected by the pandemic this year.

The cumulative exposure to unemployment as measured by the total number of initial claims should not be read as parallel to one claim and one worker, because some workers may have experienced multiple separations and had multiple initial claims. However, it does closely represent the magnitude of the number of separations and suggests that the total number is much higher.

As the year comes to a close, so will the remaining unemployment programs. Without these programs, policymakers will be handicapped when determining the strength of the economy. Without the PUA and the PEUC, we would not know about the additional 13 million workers who are jobless. As it stands, other aspects of the CARES Act have also expired, including the moratorium on evictions and foreclosures. The payments through unemployment insurance could be all that is keeping families fed and workers housed.

Coronavirus cases have been increasing across the United States since early fall and are anticipated to continue increasing throughout the winter months. States have already begun enacting economic restrictions, including limited indoor dining or limited operating hours at gyms and restaurants. It is unlikely that the labor market will recover during this time, but the extension of these pandemic unemployment programs would continue to provide relief to families and workers who are facing the health and economic crises simultaneously.

*This link will update to the newest BLS report which is released every Thursday morning at 8:30 a.m. EST.

Stuart Andreason is the director of the Center for Workforce and Economic Opportunity, where Katherine Townsend is a research analyst I.