The Power of Anecdotal Data

Elizabeth Bogue Simpson

August 21, 2024

2024-02

https://doi.org/10.29338/wc2024-02

Download the full text of this paper (222 KB)

We know that many individuals, families, and communities face systemic barriers to economic prosperity—particularly historically underserved communities and people of color.1 The Atlanta Fed has made improving economic mobility and resilience a guiding principle, prioritizing listening, learning, researching, educating, convening, and collaborating with those who can take action to create a more inclusive and resilient economy.2

A key component of the Atlanta Fed's work is gaining a holistic understanding of economic conditions in the Southeast. Traditional, quantitative measures of economic health like the unemployment rate and consumer price index are a critical piece of this puzzle. However, we also know that aggregated data doesn't always capture the full picture of what is happening on the ground. Without digging into the narrative behind the numbers, it can be difficult to tease out how particular segments of the economy are responding to changing conditions. It is sometimes through anecdotal data that we hear conditions are getting better or worse before such realities reveal themselves in the economic data.

As Chair Powell noted in his press conference on January 31, 2024, "[s]tarting with GDP data is—and working into what's actually affecting people's lives is—is challenging." He added "I really like anecdotal data…The 12 Reserve Banks have really the best network of anyone. In all their Districts, they're talking to not just the business community." Chair Powell also goes on to say, "I personally find it very helpful in understanding what's going on. … I think you hear things before they show up in the data sometimes."3

Atlanta Fed President Raphael Bostic also underscored the importance of anecdotal data in a recent blog post: "conditions can change so quickly—often before showing up in the data—that I can't imagine not using anecdotal reports from employees and employers in our policy formulations at the Atlanta Fed."4

So, the Atlanta Fed both analyzes economic data and asks business and community partners about how small businesses, households in low- and moderate-income circumstances, nonprofits, larger corporations, and consumers are faring. But how does the Atlanta Fed collect anecdotal insights, and what do we do with them?

How the Atlanta Fed goes beyond the Quantitative Data

The Community and Economic Development team regularly conducts listening sessions and community visits to hear from local government, workforce development, and nonprofit leaders to understand how low- and moderate-income families are faring. Ongoing efforts like these aim to include community voices in conversations about the economy. The Worker Voices Project, for example, is a large-scale qualitative research initiative that speaks directly with individuals in low- and moderate-wage jobs to understand their financial and labor market experiences.

In late 2023, the Atlanta Fed began a new partnership with the workforce development nonprofit SkillUp Coalition as a quantitative expansion of the Worker Voices Project. The goal of the new partnership is for the Fed to gain more real-time insights from workers and job seekers, particularly those without a bachelor's degree, thereby giving us additional insight into the experience of populations who may have more challenging experiences in the labor market.

New Inputs: Additional Anecdotal Data on Workers and Job Seekers

SkillUp Coalition serves as a marketplace for job training and career opportunities that "enable job seekers to break into new careers regardless of their degree-holding status."5 As discussed in a Worker Voices Project special brief, non-degreed workers and job seekers face unique and heightened barriers to obtaining high-quality jobs.6 Yet, conversations the Fed had with these workers revealed that they remain motivated to improve their economic outcomes despite the challenges that they face.7

SkillUp surveys their users quarterly to understand their needs and experiences in order to improve their training and career services. Most survey respondents are non-white, do not hold bachelor's degrees, earn less than $40,000 per year, and are female. Additionally, because SkillUp connects users with job training opportunities, respondents are likely individuals actively seeking to gain skills and move into better jobs.

At the inception of the partnership in 2023, the Fed had the opportunity to add several questions to the SkillUp survey specifically aimed at learning about the financial well-being and labor market experience of its respondents. The new questions include: "In the last six months, have your household expenses increased, decreased, or stayed the same" and "Currently, how would you rank your concern of your finances?". The Fed analyzed the survey results over three consecutive quarters in 2023 and 2024; the most recent quarterly survey contained responses from over 5,000 individuals across the United States.

What Have We Learned Through this New Partnership?

Household Finances

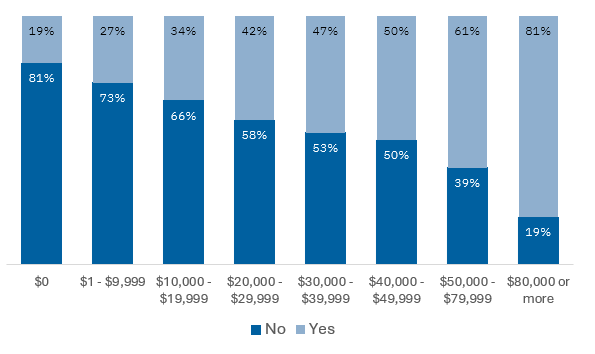

The Atlanta Fed seeks to understand household finances as a measure of economic stability. Survey results indicate that household financial conditions have improved somewhat for the survey respondents since the fourth quarter of 2023. Nevertheless, most respondents indicated that their expenses exceeded employment income (figure 1). Even a number of those at upper income levels of the survey's respondents reported challenges—nearly 20 percent of those making over $80,000 annually reported that their income did not typically cover expenses over the last six months.

Figure 1: Income Covered Expenses over Six Months

Source: Author's analysis of data from SkillUp Coalition, May 2024 (n= 4,278).

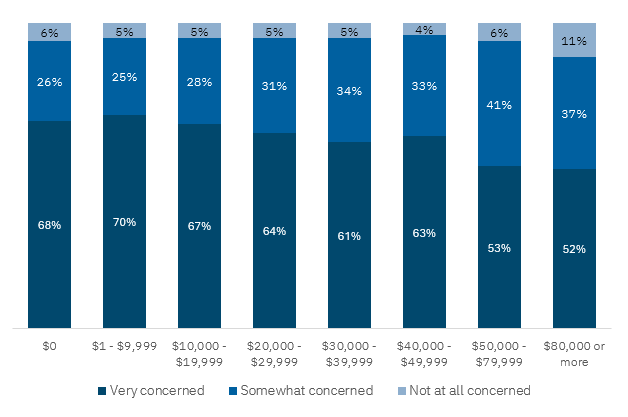

Most respondents expressed concern about their finances, and that share of the respondents has not decreased in the three quarters the Fed has been collecting data (figure 2). This echoes what we heard from a similar population of workers in 2022, most of whom felt that their financial situations were continuously precarious.8

These sentiments also echo what the data was saying about the broader economy at the time the survey was fielded. Despite progress made on inflation since its peak in May 2022,9 prices of household necessities like groceries, electricity, and gas remained elevated in June,10 which disproportionally burdens lower-income households.11

Figure 2: Financial Concern by Salary

Source: Author's analysis of data from SkillUp Coalition, May 2024 (n= 4,278).

Labor Market Experience

Most SkillUp survey respondents are actively planning to find a new and/or better job in the next three months. Typically, they are looking in a different industry than that of their current job and primarily in fields for which SkillUp has training pathways, such as healthcare, supply chain and logistics, and technology. Higher pay has been the primary motivator for these job seekers across all three quarters of data.

Overall confidence in the labor market remained high for these respondents. As of May 2024, a large majority are at least somewhat confident in their ability to find a new job between May and November 2024. However, the level of confidence has declined slightly; a smaller percentage of respondents in Q2 2024 reported that they are "very confident" than in Q4 2023 and Q1 2024. This slight decline in confidence mirrors the May data from the US Bureau of Labor Statistics, which has reported a marginal decrease in job openings over the course of 2024.12

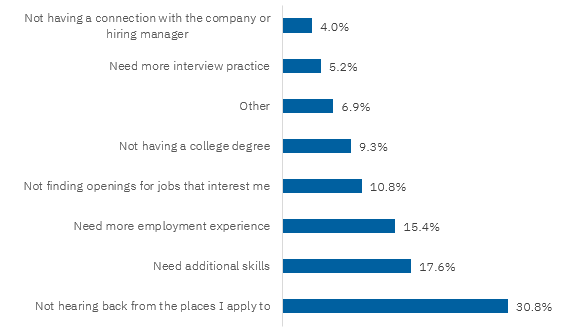

Additionally, workers in this sample continue to face obstacles in their job search and consistently report that not hearing back from employers is the most common challenge of the job market (figure 3).

Figure 3: Most Common Challenge of the Job Market

Source: Author's analysis of data from SkillUp Coalition, May 2024 (n= 3,264).

We note that these challenges are not unique to SkillUp participants; research from the Federal Reserve Bank of Minneapolis in 2023 revealed similar experiences with barriers to finding jobs. Additionally, many 2022 Worker Voices Project focus group participants who were looking for jobs also reported not hearing back from potential employers. One worker told us:

Even though I have 10 years in warehouse management, that should be sufficient enough for it. Like I said, I probably have 30 applications on each one of these [job application tracking] sheets I have. And there's six sheets. And five called back.

How Are We Using this Information?

Informing research and engagement agendas

The Atlanta Fed uses the anecdotal data to inform the Bank's community development research and engagement agenda. Our research and other programming aim to be responsive to the needs of the community by highlighting and investigating critical, emergent issues in the economy. Additionally, staff across the bank synthesize the data and activate these learnings to share insights with communities across the Southeast in response to needs that emerge from our listening efforts within our network of workers, non-profits, and other community partners.

Informing community development partners

The Fed is positioned to convene a wide range of organizations, always with the intention to provide added value to our partners and stakeholders. Engaging government, non-profit, and community partners in programs such as the Southeastern Cities Economic Inclusion Initiative facilitate peer learning and dissemination of best practices across our network. These convenings give us the opportunity to share what we have learned with partners positioned to transform our data and insights into meaningful actions for the populations they serve.

Informing internal and external policymakers

Where possible, we elevate anecdotal data and learnings from our partners to facilitate a more holistic view of economic conditions. Insights from Atlanta Fed listening sessions and other outreach with community partners are specifically highlighted in the Community Perspectives section of the Beige Book (a publication from the Federal Reserve System on economic conditions in each district). Additionally, while the Fed does not lobby for legislation, the Atlanta Fed's research has been used to inform policy at the local, state, and national levels. Most recently, research and data tools from the Atlanta Fed's Advancing Careers for Low-Income Families initiative were used in the analysis for Florida legislation expanding eligibility standards for a children's health insurance program that, in turn, eliminated barriers to caregivers' career progression by addressing the financial penalty caused by earning more and exceeding the cutoff for insurance eligibility.

Looking Forward

Throughout the rest of 2024 and into 2025, we plan to host community visits, listening sessions, focus groups, and deploy surveys that will provide further nuance to the economic data that informs our Community and Economic Development agendas.

We continue to be intentional with how we engage, iterating and improving on our ability to lift up anecdotal data directly from community voices. We are committed to continue working toward a nuanced understanding of economic conditions so that we can all achieve a more inclusive and resilient economy that works for everyone.

As we advance this work, we want to hear from you. Please reach out to us here to share your economic conditions in your area, as well as your feedback on how we can make this process valuable to your community's priorities.

By Elizabeth Bogue Simpson, CED senior research analyst in the Center for Workforce and Economic Opportunity. The views expressed here are the author’s and are not necessarily those of the Federal Reserve Bank of Atlanta or the Federal Reserve System.

_______________________________________

1 N. Bhutta, et al., “Disparities in Wealth by Race and Ethnicity in the 2019 Survey of Consumer Finances,” FEDS Notes (2020), https://www.federalreserve.gov/econres/notes/feds-notes/disparities-in-wealth-by-race-and-ethnicity-in-the-2019-survey-of-consumer-finances-20200928.html; P. Kline, E. Rose, and C. Walters, “Systemic Discrimination among Large US Employers,” NBER Working Paper Series (2022), https://www.nber.org/system/files/working_papers/w29053/w29053.pdf.

2 The Federal Reserve Bank of Atlanta, https://www.atlantafed.org/economic-mobility-and-resilience.

3 Chair J. Powell, “Transcript of Chair Powell's Press Conference,” Federal Reserve Board of Governors (January 31, 2024), https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20240131.pdf.

4 Raphael W. Bostic, “How the Fed goes beyond the data to try to make the economy work for everyone,” Fed Communities (May 6, 2024), https://fedcommunities.org/how-fed-goes-beyond-data-try-make-economy-work-everyone/.

5 SkillUp Coalition, https://skillup.org/about.

6 S. Galeano, J. Rees, and E. Bogue Simpson, "Worker Voices Special Brief: Barriers to Employment," Fed Communities (2023), https://fedcommunities.org/research/worker-voices/2023-barriers-employment-special-brief/.

7 Tiffani Horton and Elizabeth Bogue Simpson, “Worker Voices Special Brief: Pursuing Advancement through Personal Investment,” Fed Communities (2024), https://fedcommunities.org/research/worker-voices/2023-pursuing-advancement-through-personal-ivestment-special-brief/.

8 S. Miller, M. Piazza, A. Putnam, and K. Broady, “Worker Voices: Shifting Perspectives and Expectations on Employment,” Fed Communities (2023), https://fedcommunities.org/research/worker-voices/2023-shifting-perspectives-expectations-employment/.

9 US Bureau of Labor Statistics, https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category-line-chart.htm.

10 US Bureau of Labor Statistics, https://www.bls.gov/news.release/cpi.t01.htm.

11 Aparna Jayashankar and Anthony Murphy, “High Inflation Disproportionally Hurts Low-Income Households,” Federal Reserve Bank of Dallas (2023), https://www.dallasfed.org/research/economics/2023/0110.

12 US Bureau of Labor Statistics, https://www.bls.gov/news.release/jolts.a.htm.