Driverless cars have made plenty of headlines, but they're vastly outnumbered by self-steering tractors. The third part of this series looks at the impact of technology on agriculture and how it has transformed one of the region's oldest industries.

When Joe Boddiford is in Atlanta, 200 miles from his Southeast Georgia farm, he can operate his irrigation systems with his smartphone. Boddiford can turn on the water to a particular set of nozzles or shut it off. He can activate an underground well or monitor the entire system. "That gives me a lot of peace of mind," says Boddiford, who grows cotton, peanuts, and corn on 2,200 acres about 60 miles from Savannah.

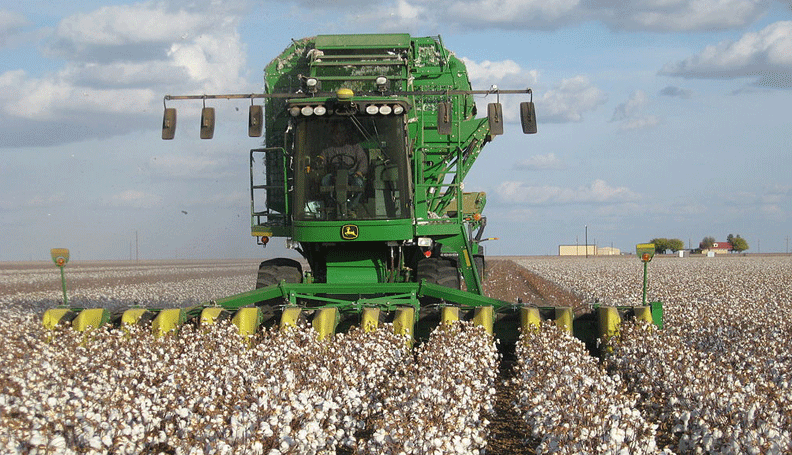

One state over, north Alabama cotton grower Larkin Martin also relies on "precision agriculture" technologies. For example, monitors installed on cotton pickers measure the yield of Martin's fields at three-foot intervals. So Martin knows, practically in real time, exactly how productive every yard of her 7,000 acres of farmland is. Using that information, she programs spreaders to apply just the right amount of fertilizer and other "inputs" exactly and only where needed. That technique has allowed Martin Farms to cut fertilizer use by 40 percent, a major cost savings in a business with thin profit margins, says Martin, a former chair of the Atlanta Fed's board of directors.

Farther west and south, red lasers pierce the summer nights on Louisiana's Cajun Prairie. The beams are gathering data on the terrain so they can better guide machines that level rice fields. This past summer, David Bertrand of Bertrand Rice had a 105-acre field leveled to within a quarter inch of perfectly flat. Level fields save water because the water doesn't run off, explains Bertrand, a member of the Atlanta Fed's agriculture advisory council.

Like most large-scale commercial farmers, these southeastern growers have embraced what is known as precision agriculture. Today, these technologies are as common on big farms as pickup trucks: GPS-guided self-steering tractors, programmable boom sprayers that apply chemicals in precise quantities and locations, and smartphone apps that track, transmit, and analyze an array of data.

Precision ag is not new. Soil sensors to measure organic matter came on the scene in the mid-1980s, and yield monitors began to proliferate in the 1990s. But the pace of ag technology investment and research and development (R&D) has quickened in recent years. In fact, the U.S. Department of Agriculture noted that the past decade has brought "an explosion in the availability and use of information technology."

Demographics, environment, technology spurring ag tech

Hardware and software technologies are not the only forces propelling interest in ag tech. So are massive demographic and environmental challenges.

Start with population growth. Because of a global population forecast to increase from 7.4 billion now to about 10 billion, along with growing affluence, worldwide food demand in 2050 figures to climb by at least 60 percent from 2006 levels, according to The State of Food and Agriculture 2016 from the United Nations Food and Agriculture Organization (UNFAO). In the next 40 years, people will need to produce more food than they did in the prior 10,000 years combined, according to The Economist magazine.

That's a huge challenge, but also a big economic opportunity. Climate change is expected to create myriad, global obstacles to food production, including reduced crop yields and increased likelihood of severe droughts, according to the UNFAO report and scientists at NASA and many universities. Agriculture and forestry account for at least 20 percent of the world's greenhouse gas emissions, a big increase since 1990, the UNFAO reports. That fact makes the ag sector attractive to innovators aiming to devise new heat- and drought-resistant crops and new methods of producing food.

Finally, better and cheaper technology is fueling the growth of ag tech. As Boddiford shows, the advent of easy-to-use mobile technologies like smartphones has been critical for farmers who spend little time at a desk. Inexpensive but powerful hardware sensors have also come along to automate data collection.

Devices and applications continue to improve. Technologies including drones, satellite mapping, and even the so-called Internet of things promise to influence agriculture in the 21st century. They'll need to. Food production must become far more efficient if the world is to feed itself without inflicting great damage on the planet, says Kenneth Cassman, an emeritus professor of agronomy at the University of Nebraska Lincoln and an expert on agricultural water and resource usage.

The "grand challenge" is to achieve a 50 to 100 percent increase in agricultural yields worldwide without increasing the net amount of existing farmland, Cassman points out in a 2016 article in the Federal Reserve Bank of Kansas City's Economic Review. New land will have to be converted to farms as urbanization encroaches on agricultural acreage, but the key, in Cassman's view, is to stabilize the total amount of farmland.

There's also the notion that reducing meat consumption would help. Livestock production uses far more resources, and creates far more air pollution, than does growing crops.

Among the difficulties in meeting the grand challenge is that the rate of growth in agricultural yields—basically the volume of food produced per acre —has actually slowed over time. Researchers cite various reasons for this, from climate change to political and economic turmoil to average yields in certain places approaching their biophysical ceiling. In other words, in some locations, growers have become about as efficient as the land and weather will allow them to be.

But technological breakthroughs dating to the cotton gin in the late 1700s have advanced agricultural efficiency. Cassman notes that seed hybrids, pest management tools, yield monitors, soil testing, and so on propelled big gains in agricultural productivity during the 20th century: "There's no reason to expect it's going to be different in the future."

Field is getting crowded

There is no shortage of ag tech aspirants. Established agribusiness giants like Monsanto and Deere & Company have been joined in the field by well-funded Silicon Valley startups and mainstream technology firms such as Microsoft, Fujitsu, and Yamaha.

R&D spending has climbed at incumbent farm equipment makers. Since 1999, Deere has more than tripled its annual level of R&D spending as revenue roughly doubled. Meanwhile, Duluth, Georgia–based Agco Corporation's "engineering expenses" came to 3.8 percent of net sales in 2015, compared to just 1.8 percent in 1999.

Money has also poured into fledgling ag and food tech firms (see the chart). Investment in ag tech startups soared from $500 million in 2012 to $4.6 billion in 2015, according to AgFunder, a group that tracks agriculture-focused investing. Investment fell 20 percent during the first half of 2016 compared to the same period last year, as the larger venture capital market also declined.

Monsanto's $930 million acquisition of a climate data company started by former Google technologists is often cited as a benchmark in ag tech's recent surge. That company, the Climate Corporation, used remote sensing and other techniques to map all 25 million farm fields in America, and then overlayed on that map all the climate information the company could compile. That effort started in 2006, and by 2010, Climate Corporation's database included 150 billion soil data points and 10 trillion weather-simulations. Monsanto bought the firm in 2013 and is building maps intending to show which seed grows best in which field under what circumstances. Other big seed companies, including Du Pont Pioneer, are also developing competing products.

Adoption varies

Not all farmers, of course, have embraced these sorts of advanced technologies. Sweeping conclusions about the adoption of precision ag are difficult to make with accuracy, given the varied technologies and practices. It's also difficult to comprehensively survey a sampling of growers from among producers of row crops versus specialty crops, versus livestock, versus larger and smaller operators, points out Daniel Schmoldt, national program leader, instrumentation and sensor with the USDA's National Institute of Food and Agriculture.

But many large operators in Georgia use GPS tractor guidance systems, use their cell phones to monitor and control irrigation systems, and are familiar with yield-monitoring and field-mapping systems, says Craig Kvien, a professor of crop and soil sciences at the University of Georgia's Tifton College of Agriculture & Environmental Sciences campus. A survey by Auburn University researchers also shows that most large growers in Alabama are adopting numerous precision ag technologies. Nationally, corn and soybean growers tend to be particularly heavy users of yield-mapping tools, according to the USDA, while self-guided systems for tractors have proliferated in recent years among all large farm operators. Self-driving equipment tends to stay on exactly the right course, so it doesn't run over crops, a critically important feature of the equipment.

Still, hesitation about ag tech persists in some quarters. Farmers like Boddiford say it is important to sift through the hype, as products and services that meet real grower demand compete with others that most farmers are wary to invest in. The issue of data ownership also looms large: many farmers are hesitant to turn over their information to vendors or share it in large, widely accessible databases.

In agriculture as in other businesses, the more data, the better decisions farmers can make in general. In fact, a large public database detailing yields, soil conditions, and similar data would be ideal, Cassman says. "That's where I see the promise in moving rapidly to increase innovation and adoption of the best practices by growers," he says.

That sort of common resource could be a ways off, though. Right now, most large seed makers, equipment companies, and agribusiness services firms are trying to carve out their own segment of the marketplace, Cassman says. At the same time, he adds, many growers have not embraced the notion that everyone would benefit from sharing all their data.

Whatever happens, merely collecting data is not important—it must also be used wisely. As Boddiford and Martin point out, color-coded images illustrating the sections of a field that are particularly fertile, and parts less so, certainly hold visual appeal. "You can get a lot of pretty maps," says Martin, the Alabama cotton grower. "But if you don't change what you're doing, they're just pretty maps."