As businesses in the Southeast struggle to fill low-skill jobs, some firms say

they plan to move to places with larger pools of available workers, according

to the Federal Reserve Bank of Atlanta's new

Beige Book report![]() on regional economic conditions.

on regional economic conditions.

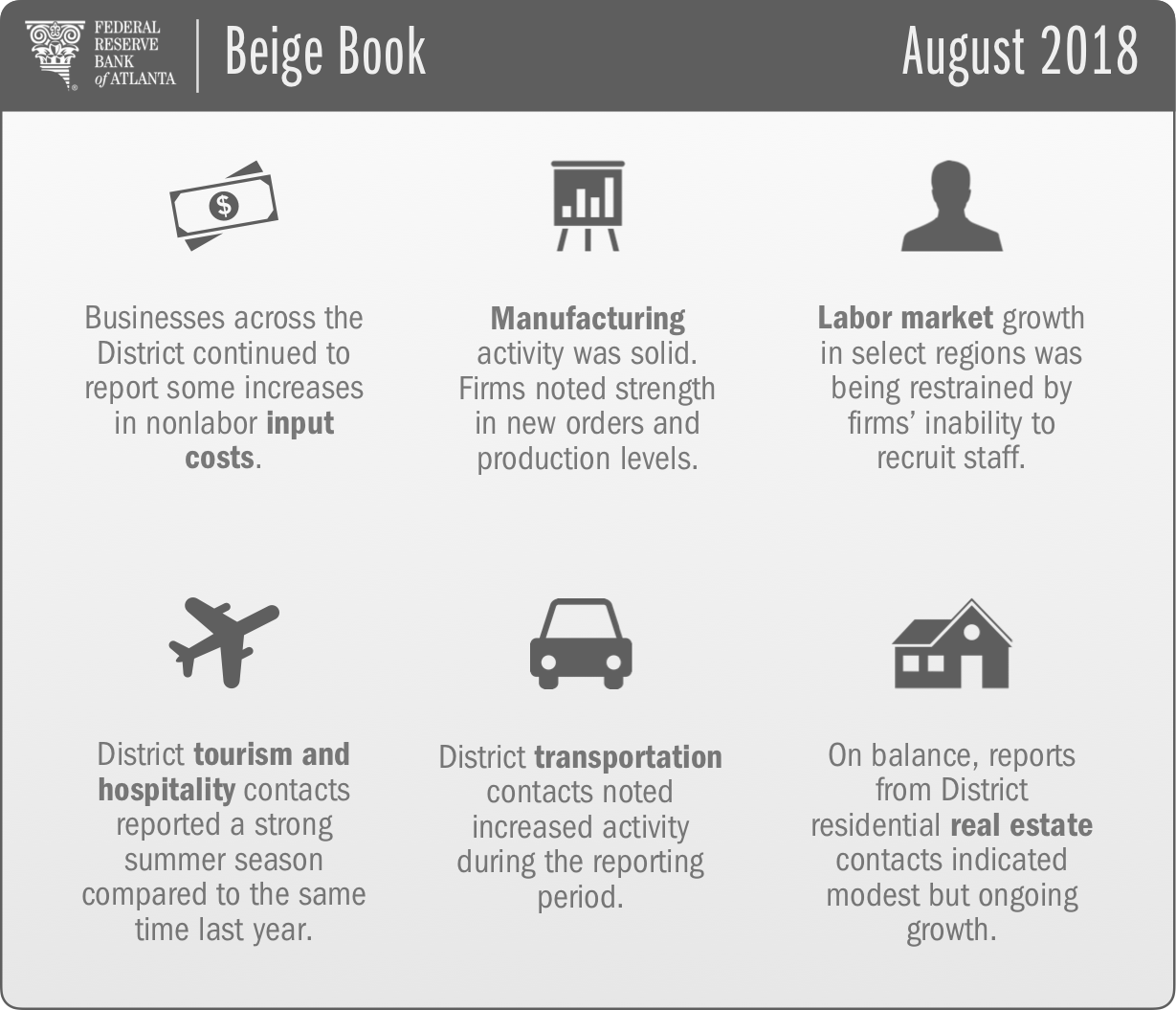

Atlanta Fed business contacts report that overall economic activity continued to expand moderately over the past month and a half. And the outlook among companies for the rest of the year remains positive, despite unease over trade policy.

Hiring challenges persist

As has been the case for about three years, firms report challenges in hiring. At first, companies mostly struggled to recruit and retain people in specialized technical fields. However, employers have more recently faced particular challenges in hiring for low-skill and hourly positions. In addition to considering relocations, firms say they are reducing their hiring standards and requirements or seeking ways to use automation instead of workers.

Meanwhile, some contacts continue to report growing pressure to raise wages. Nevertheless, according to the Beige Book, firms were offering raises greater than 2 to 3 percent only to certain groups of workers. Overall, firms continued to "approach compensation creatively," offering more worker flexibility and using bonuses, incentive pay, profit sharing, or other forms of temporary compensation.

In other economic sectors, the Beige Book finds:

- The summer 2018 tourism season was better than that of 2017. In Florida, hotel occupancy and average rate charged per room topped expectations. However, a "red tide," a toxic algae bloom that feeds on various pollutants near the coastline, killed hundreds of thousands of fish on the Florida Gulf Coast and diminished tourism during August. The tourism outlook across the Southeast is mixed for the rest of 2018, as some locales expect improved business while others do not.

- Residential real estate contacts report modest growth, but homebuilders continue to report that a lack of available lots has hindered their ability to meet demand.

- Demand for commercial real estate remained strong across the Southeast. At the same time, many commercial construction contacts say uncertainty about rising materials costs is making it harder to bid on and finish projects. On the whole, though, the outlook for nonresidential and apartment construction remains positive across the region.

- Air cargo contacts say domestic business is up because of increased e-commerce shipments. Their exports to Europe softened, and cargo volume from Latin America was robust.

- Among manufacturers, activity is strong but tariff concerns tempered the outlook. Slightly less than one-third of contacts expect higher production during the next six months.

- Tariffs are also a concern among some energy industry contacts, who worry that duties on steel and aluminum could affect the viability of plant expansion and construction projects in Louisiana.

The next

FOMC meeting![]() will be held September 25–26.

will be held September 25–26.