"Nobody's model does a very good job of how uncertainty and hits to confidence affect behavior," says Deutsche Bank's Peter Hooper in a recent Wall Street Journal article. Count us as sympathetic to his viewpoint.

That's one reason why a few of us at the Atlanta Fed created a national survey of firms in collaboration with Nick Bloom of Stanford University and Steven Davis of the University of Chicago Booth School of Business. Our Survey of Business Uncertainty (SBU) elicits information about each firm's expectations and uncertainty regarding its own future capital expenditures, sales growth, employment, and costs.

A pressing issue at the moment is whether, and how, firms are reassessing their capital investment plans in light of recent tariff hikes and fears of more to come. By raising input costs, domestic tariff hikes undercut the business case for some investments. They can raise domestic investment in newly protected industries. Retaliatory tariff hikes by trading partners can also affect domestic investment by curtailing the demand for U.S. exports. An uncertain outlook for trade policy can cause firms in all industries to delay investments while they wait to see how trade policy disputes unfold.

Last month's SBU (previously known as our Survey of Business Executives) sheds some light on these matters. We first posed a simple question: "Have the recently announced tariff hikes or concerns about retaliation caused your firm to reassess its capital expenditure plans?" Yes, said about one-fifth of our respondents.

As exhibit 1 shows, the share of firms reassessing their capital plans because of tariff worries is higher for goods-producing firms than service-providers. It's 30 percent for manufacturers and 28 percent in retail & wholesale trade, transportation and warehousing. In contrast, it's only 14 percent among all service providers in our sample. These sectoral patterns make sense, given that manufacturing firms, for example, are more engaged in international commerce than most service providers.

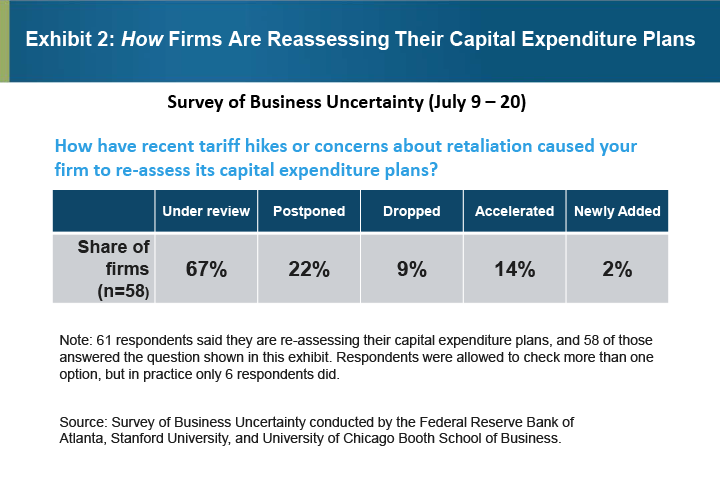

We also asked firms how they are reassessing their capital expenditure plans in light of tariff worries. Exhibit 2 provides information on this issue. Among firms reassessing, 67 percent have placed some of their previously planned capital expenditures for 2018–19 "under review," 31 percent have "postponed" or "dropped" previously planned expenditures, 14 percent have "accelerated" their plans, and 2 percent (one firm) added new capital expenditures for 2018–19.

Finally, we asked firms how much tariff worries affect their previously planned capital expenditures. Among firms re-assessing, an average 60 percent of their capital expenditure plans are affected. The predominant form of reassessment is placing previously planned capital expenditures "under review."

Let's sum up: About one-fifth of firms in the July 2018 SBU say they are reassessing capital expenditure plans in light of tariff worries. Among this one-fifth, firms have reassessed an average 60 percent of capital expenditures previously planned for 2018–19. The main form of reassessment thus far is to place previously planned capital expenditures under review. Only 6 percent of the firms in our full sample report cutting or deferring previously planned capital expenditures in reaction to tariff worries. These findings suggest that tariff worries have had only a small negative effect on U.S. business investment to date.

Still, there are sound reasons for concern. First, 30 percent of manufacturing firms report reassessing capital expenditure plans because of tariff worries, and manufacturing is highly capital intensive. So the investment effects of trade policy frictions are concentrated in a sector that accounts for much of business investment. Second, 12 percent of the firms in our full sample report that they have placed previously planned capital expenditures under review. Third, trade policy tensions between the United States and China have only escalated since our survey went to field. The negative effects of tariff worries on U.S. business investment could easily grow.

By David Altig, executive vice president and research director in the Atlanta Fed's Research Department,

By David Altig, executive vice president and research director in the Atlanta Fed's Research Department, Nick Bloom, the William D. Eberle Professor of Economics at Stanford University,

Nick Bloom, the William D. Eberle Professor of Economics at Stanford University, Steven J. Davis, the William H. Abbott Professor of International Business and Economics at the Chicago Booth School of Business and a senior fellow at the Hoover Institution,

Steven J. Davis, the William H. Abbott Professor of International Business and Economics at the Chicago Booth School of Business and a senior fellow at the Hoover Institution,  Brent Meyer, a policy adviser and economist in the Atlanta Fed's Research Department, and

Brent Meyer, a policy adviser and economist in the Atlanta Fed's Research Department, and  Nick Parker, the Atlanta Fed's director of surveys

Nick Parker, the Atlanta Fed's director of surveys