The key to successful commercial real estate (CRE) lending is the development of a robust risk management framework that includes strong underwriting standards and credit administration practices. A January 2013 Government Accountability Office (GAO) study, Financial Institutions Causes and Consequences of Recent Bank Failures, noted that 85 percent of the 414 financial institutions that failed between January 2008 and December 2011, had less than $1 billion in assets.

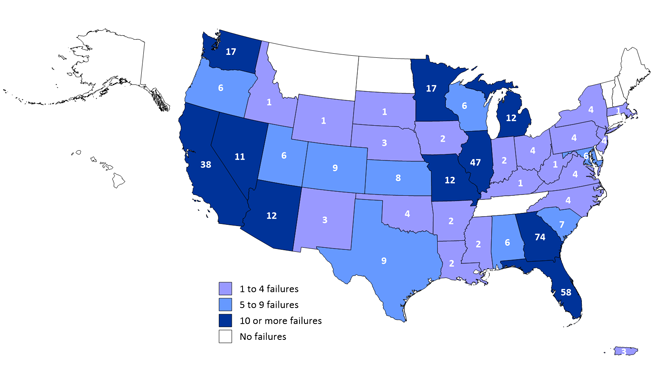

The study also found that the failed financial institutions pursued aggressive growth strategies, combined with weak underwriting standards and weak credit administration practices. These actions led to high CRE concentrations that increased the banks' exposure to the sustained real estate and economic downturn that began in 2007. As the figure below shows, 10 states experienced 10 or more bank failures between 2008 through 2011. Together, failures in these 10 states made up 298 of the 414 bank failures (72 percent) across all states during this time period.

This article addresses the importance of the adequacy of sound risk management when high levels of CRE concentrations raise credit risk. For purposes of this article, a CRE loan refers to a loan where the use of funds is to acquire, develop, construct, improve, or refinance real property and where the primary source of repayment is the sale of the real property or the revenues from third-party rent or lease payments. CRE loans do not include ordinary business loans and lines of credit in which real estate is taken as collateral. (Such loans are often described as loans secured by nonfarm nonresidential properties where the primary source of repayment is the cash flow from the ongoing operations and activities conducted by the party, or affiliate of the party, who owns the property. This information is detailed in SR Letter 15-17, Interagency Statement on Prudent Risk Management for Commercial Real Estate Lending, and SR Letter 07-01, Interagency Guidance on Concentrations in Commercial Real Estate.)

Regulatory framework

Supervision and Regulation Letter 07-1, Concentrations in Commercial Real Estate Lending, Sound Risk Management Practices was issued in December 2006 to address institutions increased concentrations of commercial real estate (CRE) loans. The guidance emphasizes the importance of strong risk management practices and appropriate levels of capital when concentrations of credit exposures add a dimension of risk that compounds the risk inherent in individual loans. SR Letter 15-17, Statement on Prudent Risk Management for Commercial Real Estate Lending was issued in December 2015, to reinforce existing guidance because the regulatory agencies observed substantial growth in many CRE assets and lending markets, increased competitive pressures, rising CRE concentrations in banks, and an easing of CRE underwriting standards, including less restrictive loan covenants, extended maturities, longer interest-only payment periods, and limited guarantor requirements.

Currently, there is some concern that the credit cycle may be about to change. Community banks that identify, monitor, manage, and control risks arising from CRE lending activity should maintain underwriting discipline and prudent risk management practices. Financial institutions should meet regulatory expectations found in SR 15-17. The regulatory expectations indicate that financial institutions should:

- review their CRE policies and practices to ensure consistency with current growth strategies and risk appetite,

- maintain sound risk management practices that support strategic initiatives and portfolio composition, and

- maintain capital levels commensurate with the level and nature of their CRE concentrations risk.

Consider the following scenario:

ABC Bank is located on the Gulf Coast in a high income, high net worth market where the economy is heavily reliant on the oil and gas industry. The firm has traditionally maintained a wealth management lending strategy. The strategic initiative focuses on lending to individuals with substantial liquidity, net worth, and disposable income. Loans are typically well secured by cash collateral. The bank has experienced nominal losses as a result of its lending strategy and as a result, the allowance for loan and lease losses (ALLL) is relatively low when compared to peers of comparable asset size. Further, capital levels are sufficient for the bank's risk profile and the inherent risk in the loan portfolio. Bank management has noted an increase in CRE development in the market, resulting in an increase in construction and land development (CLD) lending by its competitors. In an effort to increase earnings bank management adds CRE lending, focusing on CLD loans, to its strategy as a growth initiative. The lending staff has wealth management and consumer lending experience. What should management do prior to moving forward with a CRE growth strategy?

Management must ensure that a sound risk management framework is in place to support the CRE growth initiative. Management should also consider the level and nature of expected growth when developing and implementing CRE policies and procedures if CRE concentrations are expected to approach or exceed the supervisory criteria found in SR 07-01:

- Total reported loans for construction, land development, and other land represent 100 percent or more of the institution's total capital; or

- Total commercial real estate loans as defined in SR 07-01 represent 300 percent or more of the institution's total capital, and the outstanding balance of the institution's commercial real estate loan portfolio has increased by 50 percent or more during the prior 36 months.

Risk and concentration limits should be set that are aligned with the firm's risk appetite and tolerances. Sound underwriting policies commensurate with this risk, as well as lending and risk management staff with the appropriate skills should be hired to grow and manage the inherent risk in CRE loans. Management Information Systems (MIS) should be robust, appropriately capture risk in the portfolio, and accurately report the performance of the CRE portfolio. Management should ensure that the ALLL and capital levels are adequate and sufficiently support the bank's risk profile.

Key elements

Key CRE risk management elements noted in SR 07-01 are essential to establishing an effective risk management framework, and the figure below depicts them.

- Board and management oversight

The board of directors has the ultimate responsibility for a financial institution's level of CRE risk. The firm's strategic plan should address significant CRE concentrations as a growth initiative including financial targets and a capital plan. In addition, real estate lending regulations require that firms adopt and maintain a written policy that establishes appropriate limits and standards for all extensions of credit that are secured by liens or interests in real estate, including CRE loans. The board of directors should also - establish policy guidelines and approve the overall lending strategy,

- ensure that management implements procedures and controls to effectively adhere to and monitor compliance with the institutions lending policies and strategies,

- review information that identifies and quantifies the nature and level of risk, and

- periodically review and approve CRE risk exposures and limits and appropriate sub limits to conform to changes in strategies and to respond to changes in market conditions.

- Portfolio management

Risk should be managed at the individual loan level and at the portfolio level, specifically concentration risk that is affected by cyclical changes in CRE markets. Unexpected or unanticipated market changes can result in unacceptable levels of risk if not properly managed. In the example, ABC Bank added CRE lending as a strategic initiative as a result of CRE activity in its market. What happens if there is a downturn in the energy market and local CRE development is curtailed? Firms such as ABC Bank should develop contingency plans to mitigate such risks. Examples of strategies to actively manage concentration risks include engaging in loan participations and loan sales. Additionally, firms should test the marketability of the portfolio if the contingency plan relies on loan sales. Management should regularly evaluate the degree of correlation between related real estate sectors and establish internal lending guidelines and concentration limits that control the institutions overall risk exposure. - Management information systems

A strong and robust management information system (MIS) is key to a sound risk management framework and portfolio management. The sophistication and complexity of the MIS will vary based on the size and complexity of the CRE portfolio and the level and nature of concentration risk and should go beyond reporting nonperforming loans. Low levels of nonperforming loans do not necessarily indicate strong risk management practices. Reports to the board of directors should be timely and accurate and contain sufficient information for leadership to identify adverse trends and identify risks to the financial institution. Further, portfolio MIS should be used to identify changes in underwriting that indicate loosening or tightening of CRE underwriting standards. Some examples of CRE credit factors that may be monitored and additional considerations include: - Debt service coverage ratio trends. Are coverage ratios declining, and why?

- Loan-to-value (LTV) trends. Are LTVs consistent with real estate regulations, and do trends indicate declining real estate values?

- Cash equity injections at origination. Are loans properly margined at origination and consistent with bank policy?

- Length of amortization trends. Are amortizations being extended to sidestep underwriting standards?

- Length of interest only periods and changes since origination. Is interest being capitalized to delay recognition of risk and problem loans?

- Multiple renewals. Are loans being renewed to delay recognition of risk?

- Budget overages. Were financing needs underestimated at origination, is the project managed properly, and are payments by the financial institution managed appropriately?

- Projects are not on schedule. Are construction projects underperforming or not performing?

- Trends in policy exceptions. Are exceptions approved, are exceptions increasing, and are exceptions concentrated by region or loan officer?

- Market analysis

Institutions should perform market analysis when entering new markets, changing or expanding lending strategies, or expanding in existing markets to assess market conditions. In the example, ABC Bank plans to add CRE lending, specifically CLD loans, to its loan book. The decision to do so is based on observed growth in the market and anecdotal information. This approach does not inform the board of directors and management regarding the viability of a CRE growth strategy and is not a sufficient resource. An effective approach to conducting market analysis should include published research data, real estate appraisers and agents, information maintained by the property taxing authority, local contractors, builders, investors, and community development groups. - Credit underwriting standards

CRE lending policies should reflect a firm's risk tolerance and should be clear and measurable. Policies should address maximum loan amount by property type; loan terms; pricing structures; collateral valuation; LTV limits by property type; requirements for feasibility studies and sensitivity analysis or stress testing; minimum requirements for initial investment and maintenance of hard equity by the borrower; and minimum standards for borrower net worth, property cash flow, and debt service coverage for the property. Exceptions to policy should be documented and include the rationale for the policy exception. Exceptions to both the institution's internal lending standards and the regulatory agencies' supervisory LTV limits should be monitored and reported on a regular basis. Firms should also analyze trends in exceptions to ensure that risk remains within established risk-tolerance limits. - Portfolio stress testing and sensitivity analysis

Stress testing practices and sensitivity analysis should be consistent with the size, complexity, and risk characteristics of the composition of the CRE portfolio. The analysis should address the potential effect of stressed loss rates on the CRE portfolio, capital, and earnings. In the example, ABC Bank's stress testing should be performed on the CRE portfolio to assess the potential effect of stressed loss rates on capital and earnings. The effect should differ significantly from the core wealth management loan portfolio. If the results reveal a negative effect on capital and earnings, management should have a contingency plan to mitigate the risk of the stressed scenario. - Credit risk review function and risk rating

A strong credit risk review function is essential to a firm's self- assessment, timely identification of emerging risks, and a sound risk management framework. The credit risk review function should assess credit and, ultimately, identify problem loans. A key function is the assessment of risk ratings. Risk ratings should be appropriate for CRE loans underwritten by the financial institution and should be reviewed regularly for appropriateness.

The question is why? Trends that identify increasing or excessive risk indicate the need to further assess and mitigate risk in portfolios, individual loans, projects, or lending personnel.

Keeping risk management CRE in mind down the road

The need for sound risk management cannot be understated. Firms should stay apprised of regulatory guidance and ensure that expectations are met. (The commercial bank examination manual and the bank holding company supervision manual, both from the Fed's Board of Governors, are resources.) Activities and associated documentation should clearly reflect this. CRE risks should be appropriately identified, monitored, measured and controlled as examiners will consider the nature of inherent risk as a result of CRE growth. Examiners will also assess the implications of the growth on asset quality, earnings, and capital, as well as assessing the level of the ALLL in relation to the CRE growth and concentrations levels, for consistency with the heightened risk that results from the CRE growth and concentration. Examiners may ask institutions that have inadequate risk management practices and capital strategies to develop a plan to better manage CRE concentrations. Actions may include reducing risk tolerances in the firm's underwriting standards, or raising additional capital to mitigate the risk associated with the firm's CRE strategies or exposures, particularly if the concentration levels exceed CRE guidance supervisory criteria for construction and land development and nonowner-occupied CRE.