External researchers can now request SBU microdata that have had identifying characteristics removed. To initiate a request, please complete this form.

For further detail into the construction of these series, please see our accompanying methodology slide deck.

Stay informed of all Survey of Business Uncertainty updates by subscribing to our mailing list, downloading our EconomyNow app, or following the Atlanta Fed on Twitter. ![]()

De-identified SBU microdata is now available for use by external researchers. Please complete the request form.

Dave Altig is executive vice president and chief economic adviser at the Federal Reserve Bank of Atlanta. He serves on the executive leadership team for the Bank's economic mobility and resilience strategic priority, is an executive cosponsor of the Working Families Employee Resource Network, and is an adviser to the executive leadership committee.

Jose Maria Barrero is an Assistant Professor of Finance at Instituto Tecnológico Autónomo de México, where he conducts empirical and quantitative research in macroeconomics and finance, focusing on firm behavior under uncertainty. He joined the SBU research team while he was a PhD student at Stanford University. He holds a BA in Economics and Mathematics from the University of Pennsylvania and an MA and PhD in Economics from Stanford University.

Nick Bloom is a professor of economics at Stanford University and a codirector of the Productivity, Innovation and Entrepreneurship program at the National Bureau of Economic Research. His research focuses on management practices and uncertainty. He previously worked at the U.K. Treasury and McKinsey & Company. He holds a bachelor's degree from Cambridge University, a master's degree from Oxford University, and a PhD from University College London.

Steven J. Davis is a senior fellow at the Hoover Institution, a senior fellow at the Stanford Institute for Economic Policy Research (SIEPR), and professor emeritus at the University of Chicago Booth School of Business. His research focuses on labor market outcomes, business performance, economic fluctuations, and uncertainty. He is an elected fellow of the Society of Labor Economists, former editor of the American Economic Journal: Macroeconomics, economic adviser to the U.S. Congressional Budget Office, and senior fellow with the Asian Bureau of Finance and Economics Research. He is also a co-creator of the Economic Policy Uncertainty Indices, and he co-organizes the Asian Monetary Policy Forum, held annually in Singapore. Davis received a PhD in economics from Brown University in 1986 and joined the Booth faculty in 1985.

Brent Meyer is an assistant vice president and economist in the research department at the Federal Reserve Bank of Atlanta. His primary research interests include firm behavior, survey methods, inflation, inflation expectations, macroeconomics, and monetary policy. In addition to providing monetary policy support, Meyer heads up our Economic Survey Research Center (ESRC), is involved in research using our Business Inflation Expectations (BIE), Survey of Business Uncertainty (SBU), and CFO surveys, contributes to the Atlanta Fed's Inflation Project, and to the Atlanta Fed's macroblog, which provides commentary on economic topics, including monetary policy, macroeconomic developments, and the Southeast economy. Meyer earned a bachelor's degree in economics from Hillsdale College and a master's degree in economics from Bowling Green State University.

Kevin Foster is a Survey Director at the Federal Reserve Bank of Atlanta. He has been leading survey efforts in the Federal Reserve System since 2009, and before that at the United States Census Bureau starting in 2004. Foster contributes to policy and research through his roles on the Survey & Diary of Consumer Payment Choice, the Business Inflation Expectations survey, and the Survey of Business Uncertainty.

Emil Mihaylov is a Quantitative Research Analysis Specialist at the Federal Reserve Bank in Atlanta. He has been responsible for analyzing the SBU data since 2019. His other areas of research include macroeconomics, forecasting, and data and statistical analysis.

Grace Guynn is a survey manager in the Research Department at the Federal Reserve Bank of Atlanta. She is responsible for leading survey operations for the Economic Survey Research Center, including the recruitment and retention of business leaders in the Survey of Business Uncertainty (SBU), the CFO Survey and Business Inflation Expectations Survey (BIE).

Michael Bryan was a vice president and senior economist in the research department of the Federal Reserve Bank of Atlanta, where he was responsible for organizing the Atlanta Fed’s monetary policy process. He came to the Atlanta Fed in 2008, and retired from there in 2016. Before coming to Atlanta, Bryan was at the Cleveland Fed, where he had spent 30 years in positions of increasing responsibility. Bryan is currently serving on the faculty of the University of South Carolina.

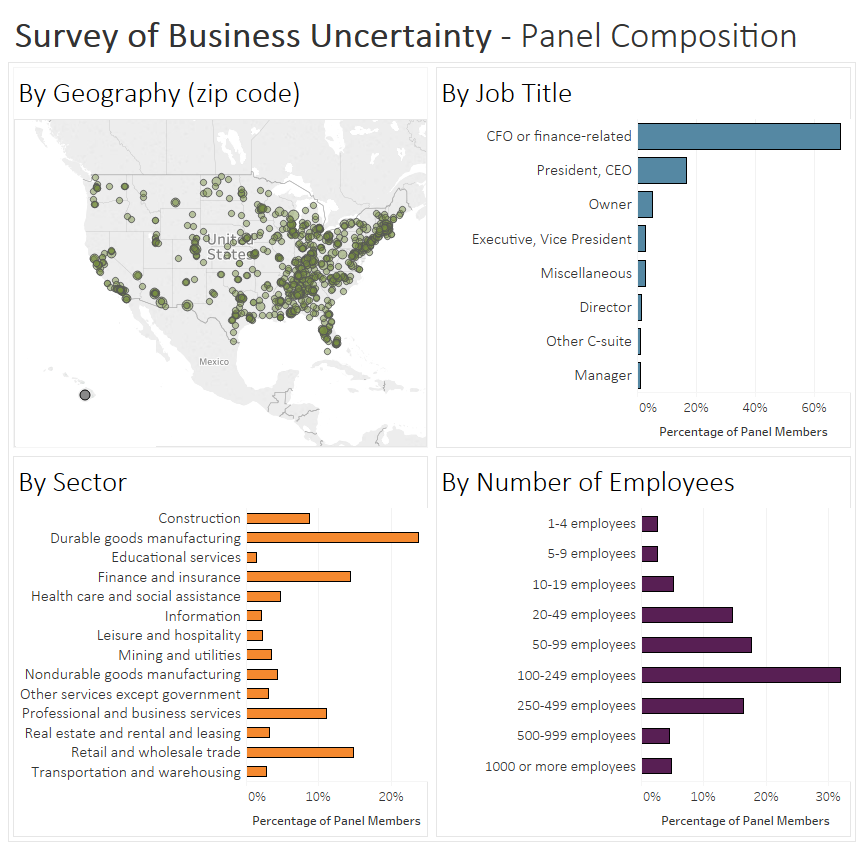

The SBU elicits a 5-point probability distribution over 12-month-ahead sales, and employment for each firm. It also elicits current values of these quantities. The survey's innovative design allows the calculation of each firm's expected growth rate over the next year and its degree of uncertainty about its expectations. Policy makers and researchers can use SBU data to help forecast economic activity and better understand how business expectations and uncertainty affect employment, sales, investment, and other economic outcomes.

For information on how the Atlanta Fed handles participant data from this survey, please refer to our online privacy policy.

The Federal Reserve Bank of Atlanta fields the Survey of Business Uncertainty in partnership with Steven Davis of the University of Chicago Booth School of Business and Nick Bloom of Stanford University. Davis and Bloom are the creators of the Economic Policy Uncertainty (EPU) indices and experts in the field.

Please consult "Surveying Business Uncertainty" by David Altig, Jose Maria Barrero, Nicholas Bloom, Mike Bryan, Steven J. Davis, Brent H. Meyer, and Nicholas Parker. Additional information about the methods used for the survey can be found in the accompanying slide deck.

Panel members are split evenly into two groups. A given panel member will rotate between the sales revenue and employment forms, responding to each questionnaire every other month. In addition to the core survey questions posed in the forms below, we typically ask at least one special question each month.

The Survey of Business Uncertainty will be released by 11 a.m. ET on the following dates:

2025

January 29

February 26

March 26

April 30

May 28

June 25

July 30

August 27

September 24

October 29

November 26

December 24

2026

January 28

February 25

March 25

April 29

May 27

June 24

July 29

August 26

September 30

October 28

November 25

December 30